- Synchrony has close to a 6 – 6.8% of Total Loans Receivable as Provisions.

- Industry Standard for Loan Loss provisions is 2 – 2.5% of Total Loans Receivable.

- What does this mean to quality of assets listed on their balance sheet.

Synchrony financial (SYF) deals in the private credit line for business. They have a very unique position in the health care sector compared to other banks. After buying Citi Corps portfolio of consumer credit debt in healthcare, Synchrony has become a dominant player in that arena.

While the company enjoys the “moat” of competitive advantages, analysts worry about asset quality especially after the last earning release in Q1.

Even with earnings beating the Streets expectations by close to 9%, the share price remained relatively unchanged. This primarily has to do with the quality of loans in Synchrony Financials portfolio. In the chart below, it is evident how the relative percentage of coverage for loan loss stacks up to its competitors.

Two of the largest banks, Citi and Wells Fargo, have had decreasing percentages of loan loss provisions. In addition to lower percentages in subsequent years, they are also significantly lower than Synchrony Financial and Capital One.

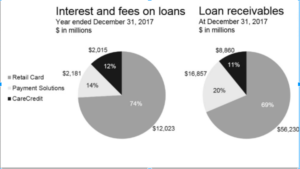

Seeing how high the provisions are for these losses, warrants a special look at the quality of these loans. The graph below, from Synchrony’s 2017 annual report, shows the breakdown of the loans they have been amassing.

Seventy percent of all Loan receivables come from their Retail Credit line. It also demonstrates the significant amount of 20% from their payment solutions.

The annual report does not show what percentage of loan loss provisions are tied to each operating sector. However, any increases in allowance for Payment Solutions through the fiscal year (2018) can be accounted for through the acquisition of the PayPal portfolio. This is evident in the following quote from their 10-k, which says:

“In addition, we also expect increases to our allowance for loan losses in the second half of 2018 to establish appropriate loan loss reserves for the PayPal transaction, which we expect to close in the third quarter of 2018.”

The acquisition of this debt explains the huge uptick in Loan Loss percentage between Q’4 of 2017 and Q’1 of 2018, which was given a larger allowance. Even with the PayPal acquisition, there is no explanation for the 26% increase between 2016 – 2017.

In addition, the acquisition of PayPal debt portfolio can only explain an increase in Q’3 and Q’4 of this year. So naturally any increase in the loan loss provisions between 2017 and 2018 Q’1 & 2 must be explained.

In examining the first earnings release this year, things get even uglier with provisions for loan loss increasing tremendously y/oy from 6.37% to 7.37%. Not only is the allowance for these delinquent debts increasing year-over-year, but it is expected to get worse as the quote below will demonstrate.

“We also experience a seasonal increase in delinquency rates and delinquent loan receivables balances during the third and fourth quarters of each year.”

This is due to the latter quarters including many holidays and is known to be a huge time for consumer spending. But this means continued coverage of these through the allotment of capital.

With these huge increases of capital to cover these potential loses comes a great opportunity cost. Keeping this capital secure and away from investments means that it will be hard for management to put this capital to work.

Not only is this huge allowance for loss hindering future growth, it is also hindering current performance. At the end of fiscal year 2017, Synchrony Reported the following:

“Net earnings decreased 14.0% to $1,935 million for the year ended December 31, 2017, primarily driven by increases in provision for loan losses and other expenses.”

Although Synchrony enjoys being the largest private credit line in the world and has an unique position in the healthcare sector to provide credit, it is hindered by the allotment of capital to loan loss provisions. Synchrony is in a position to reap the benefits of its position in the healthcare industry to capture huge revenues by becoming the sole provider of consumer credit in that arena.

While Synchrony is on a strong footing in its private credit line business, it has some major obstacles to overcome in the future which investors need to continually monitor.