When building your portfolio, you must answer one question: What are your goals?

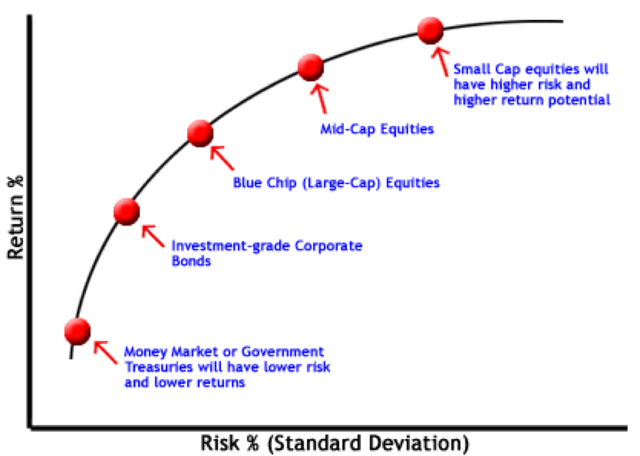

This is a difficult question to answer but a good investor wants to maximize their returns for some level of risk. This is called CAPM or Capital Asset Pricing model. CAPM is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio. We will utilize this model for setting guidelines regarding different investment strategies.

Low Risk Defensive Portfolio:

This type of portfolio is for a person who wants to realize minimal returns for almost no risk. If we are focused on conservative asset allocation than we need to look as low risk assets. Bonds tend to be an asset class with significantly lower risk than stocks but also have significantly lower returns. However, bonds are not created equal which requires us to look at some asset subclasses which we can add to our defensive portfolio.

U.S. Treasuries: Issued by the United States Department of the Treasury, these types of bonds are generally considered to be the least risky.

Municipal bonds: Debt issued by states, cities or other local government entities are commonly known as munis. These debt instruments help finance municipal activities and projects.

Corporate bonds: Corporate bonds typically have maturities of one year or longer. Corporate debt with maturities under a year is known as commercial paper. Bonds issued by companies with high credit ratings are referred to as investment grade or high grade, rated BBB and higher.

This is CAPM applied to various assets. As we can see we should focus on Government Bonds and Investment-grade Corporate debt. In addition, another very defensive position to hold is cash. Now that we know we should focus our asset allocation on government securities and investment grade bonds we can set guidelines for our defensive portfolio. If we want a relatively defensive portfolio, we can have 60% of our assets in Treasury Bills another 30% in investment grade bonds and 10% cash. Regardless of the exact percentages focusing your assets in these asset classes will make a much more defensive portfolio than a portfolio with a high exposure to the stock market.

High Risk High Return Portfolio:

If you are at the beginning of your career and have very little in savings this is the strategy you would want to follow. If we look back to our chart, we see small-size equity offerings as a risky yet fruitful investment. In addition, equities located in emerging markets tend to be very risky and offer large returns. For this portfolio we want to focus on asset classes that are very volatile and have a high beta. These assets offer the most upside yet is inherently risky. A baseline for this portfolio could be 20% large cap equities, 40% small cap equities, and 24% emerging market etf’s. We can change the degree of risk for the equity heavy portfolio by allocating more assets towards large cap equities to reduce risk or increase the capital allocation towards emerging markets to make our portfolio more volatile.

Income Investor Portfolio:

This type of portfolio is great in retirement. If you need cash and do not want to liquidate your holdings dividends are a great way to subsidize your income. This type of portfolio is relatively risky because equity prices are subject to lots of change. This portfolio is heavily focused on large cap equities that pay dividends. In order to reduce the risk of decreasing asset prices long-term options offers insurance from this risk.

Conclusion:

Portfolio building is difficult and dependent of your goals. Once you understand what you want to achieve it is easy to balance your portfolio in a way that is right for you. CAPM is a great tool to use once you understand your goals. However, the best way to reduce any risk is through extensive research. The best advice I can offer on portfolio building is to thoroughly research the assets before you aquire them.